What Are The Components Of A Formal Anti-money Laundering Program

Who should conduct the review. Our regulations require an independent review not a formal audit by a certified public.

The Essentials Of An Effective Anti Money Laundering Compliance Program Tookitaki Tookitaki

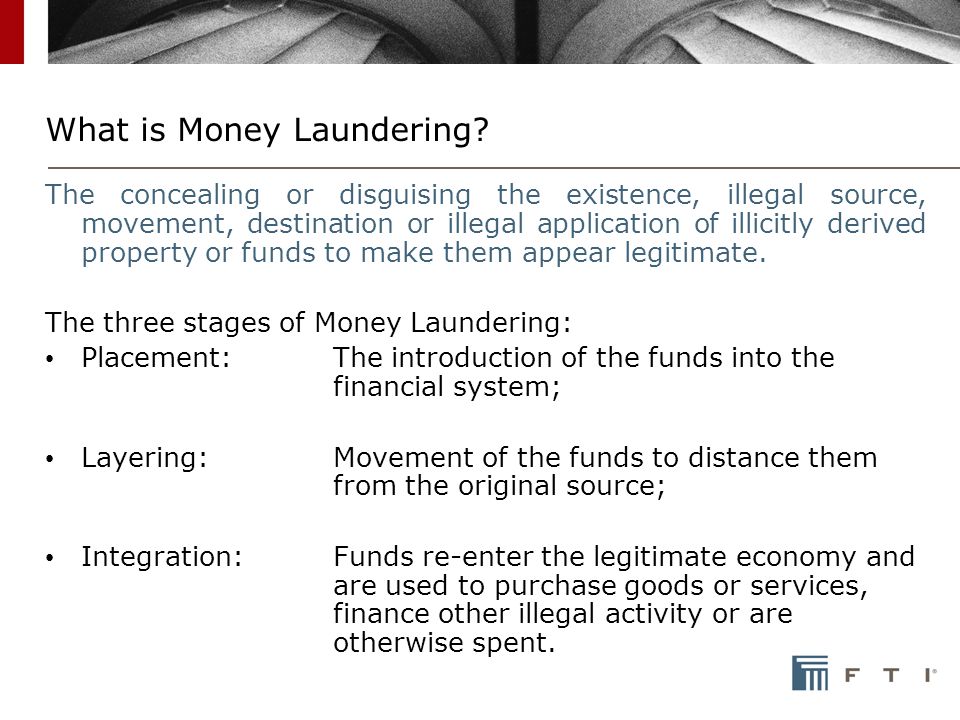

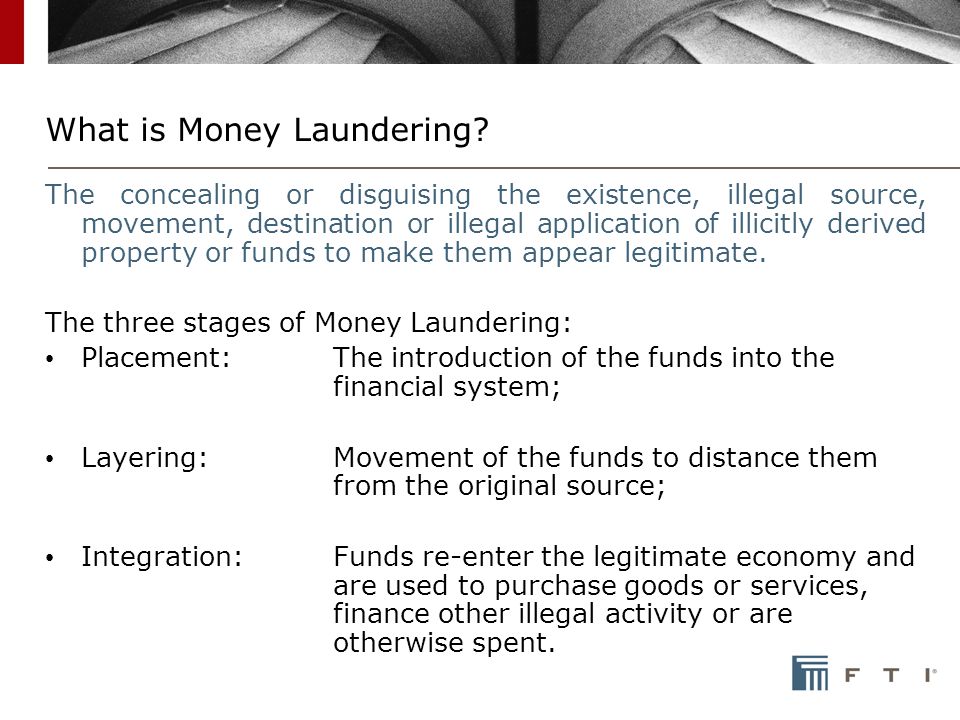

An anti-money laundering AML program is a set of procedures designed to guard against someone using the firm to facilitate money laundering or terrorist financing.

What are the components of a formal anti-money laundering program. 1 on a question. Employee training program independent audit function internal compliance officer. These programs can help prevent firms from incurring grave losses as a result of non-compliance with AML regulations.

Department of the Treasury under the USA PATRIOT Act the Financial Crimes Enforcement Network FinCEN has issued two final rules requiring certain insurance companies to implement anti-money laundering AML compliance programs and file Suspicious Activity Reports as of May 2 2006. All of the following are essential components of a formal anti-money laundering program under the USA PATRIOT Act. We have condensed the most relevant anti-money laundering legislation and regulatory boards recommendations into 6 key components.

Internal policies procedures and controls reasonably designed to assure compliance with the Bank Secrecy Act and implementing. Built-in internal operations user-processing policies accounts monitoring and detection and reporting of money laundering incidents. The main components that must be included are.

These cover how you can successfully carry out your AML obligations. Pursuant to expanded oversight granted the US. All of the following are essential components of a formal anti-money laundering program except a an independent audit function b an accreditation program c an employee training program d policies procedures and internal controls for detecting and preventing money laundering.

Designated Compliance Officer - The financial institution must appoint a person or committee to manage the anti-money laundering compliance program and make certain that all of its components are. An Anti-Money Laundering compliance program combines everything a company does to meet the compliance norms. These new rules also affect a.

The anti-money laundering program must also include a designated compliance officer an ongoing training program and an independent audit function. All of the following are essential components of a formal Anti-Money laundering program under the USA PATRIOT Act EXCEPT an Program coordinator with FATF Treasury Department that provides US. Solutions to Combat Money Laundering.

Faced by the business the frequency of Bank Secrecy Act anti-money laundering training for employees and the adoption of procedures for implementation and oversight of program-related controls and transactional systems. Policy markers with strategic analysis of domestic and worldwide money laundering developments trends and patterns. An anti-money laundering AML program is a set of policies and procedures that help to detect prevent and address money laundering.

FINRA provides a template for small firms to assist them in fulfilling their responsibilities to establish the Anti-Money Laundering AML compliance program required by the Bank Secrecy Act BSA and its implementing regulations and FINRA Rule 3310The template provides text examples instructions relevant rules and websites and other resources that are useful for developing an AML.

Https Www Econstor Eu Bitstream 10419 162698 1 891246215 Pdf

Pdf Eu Anti Money Laundering Regime An Assessment Within International And National Scenarios

Pdf Anti Money Laundering Regulations And Its Effectiveness

Pdf Multi Agent Based Simulation Mabs Of Financial Transactions For Anti Money Laundering Aml

Https Www Econstor Eu Bitstream 10419 162698 1 891246215 Pdf

Pdf Anti Money Laundering The World S Least Effective Policy Experiment Together We Can Fix It

Aml Compliance Checklist Best Practices For Anti Money Laundering

Https Www Europarl Europa Eu Regdata Etudes Idan 2021 659654 Ipol Ida 2021 659654 En Pdf

What Is An Aml Compliance Program Complyadvantage

Anti Money Laundering Aml Ppt Download

Pdf Global Financial Governance And The Developing Anti Money Laundering Regime What Lessons For International Political Economy

Certified Anti Money Laundering Professional Swiss School Of Business And Management Geneva

Https Eba Europa Eu Sites Default Documents Files Document Library News 20and 20press Press 20room Press 20releases 2020 Eba 20acts 20to 20improve 20aml Cft 20supervision 20in 20europe Aml 20cft 20factsheet Pdf

Anti Money Laundering And Ofac Compliance For Financial Institutions Ppt Download

Anti Money Laundering And Combating The Financing Of Terrorism Aml Cft Materials Concerning Staff Progress Towards The Development Of A Comprehensive Aml Cft Methodology And Assessment Process In Policy Papers Volume 2002 Issue 048

Combating Money Laundering And The Financing Of Terrorism A Comprehensive Training Guide Workbook 3a Regulatory And Institutional Requirements For Aml Cft

Pdf Compliance And Corporate Anti Money Laundering Regulation

Post a Comment for "What Are The Components Of A Formal Anti-money Laundering Program"